While the CRA Stands Against You, We Stand With You!

Need a Tax Professional? You've found the right place.

Welcome to Canadian Tax Group

Filing your own income tax return can be overwhelming, often raising more questions than answers. In addition, many people fail to get what they deserve because they lack knowledge of proper deductions and credits that one is entitled to. While computerized programs may help but nothing beats the experience of an accomplished financial advisor located in Ottawa.

Here's what you get:

When we handle your tax filings, we ensure to maximize every available incentive, break, and deduction for an accurate tax return preparation.

File your tax return electronically and receive your refund faster.

Rest assured that we minimize your taxes to the lowest legal amount by staying updated on tax legislation changes and identifying effective tax reduction opportunities.

Unlike impersonal tax software, our dedicated professional tax accountants prioritize reducing your tax burden, ensuring you never pay more than you owe.

Our Service

Personal Tax Preparation

We work closely with our clients to design plans that suit their particular needs. A proactive team provides professional tax planning and preparation services enabling you to make use of eligible expenses and credits in order to reduce tax debts while maximizing the refunds; making sure that you do not end up spending more than necessary.

What Our Clients Are Saying

Find out why clients return to us for their tax needs year after year. Our personalized and expert service has consistently delivered results. Explore their experiences and see how Canadian Tax Group simplifies tax complexities with ease and confidence. Your success is our priority.

As someone who has always found taxes confusing and stressful, I was amazed at how easy Canadian Tax Group made the entire process. They ensured that I received the highest refund possible while paying attention to every little detail without ignoring anything at all

Lucas Morgan

Switching to Canadian Tax Group was my best decision when it comes to preparing personal taxes. They spent time understanding my financial profile, thus enabling them to identify deductions I never knew existed. Highly recommended!

Sophie Martin

The team is very knowledgeable and patient as they walk me through each step of my personal taxes. Finally, I feel confident that my taxes have been done correctly, and I cannot express enough how satisfied I am with their service.

Ethan Bennett

FAQS

How can I file my taxes with Canadian Tax Group Inc.?

Filing your taxes with Canadian Tax Group Inc. is easy and convenient. Simply visit our website and create an account if you haven't already. From there, you can access our user-friendly online platform, where you'll be guided through the tax filing process step by step. Our platform is designed to make it as straightforward as possible, and if you ever have questions or need assistance, our expert team is just a message or a phone call away. We're here to support you throughout the entire process.

What documents do I need to provide for tax preparation?

To prepare your taxes accurately, we need various documents, including W-2s, 1099s, receipts for deductible expenses, mortgage interest statements, and records of other income or investments. Please also bring your previous year's tax return for reference.

How can I be sure my tax return is accurate?

Our team of experienced professionals follows meticulous procedures to ensure accuracy. We stay updated with the latest tax laws and double-check every return. Additionally, our services include a review process to catch any potential errors before submission.

What should I do if I receive a tax audit notice?

If you receive a tax audit notice, contact us immediately. Our experts will guide you through the process, help you understand the notice, and represent you during the audit to ensure your interests are protected.

How can tax planning benefit me or my business?

Tax planning helps you make informed financial decisions throughout the year, potentially reducing your tax liability and maximizing savings. Our personalized tax planning services ensure that you take advantage of all available deductions, credits, and strategies tailored to your unique situation.

Can you help me if I need an extension to file my taxes?

Absolutely. We offer hassle-free tax extension services to ensure you meet IRS deadlines. We handle all the necessary paperwork and submit your extension request, giving you extra time to prepare your tax return accurately and avoid penalties.

Get In Touch

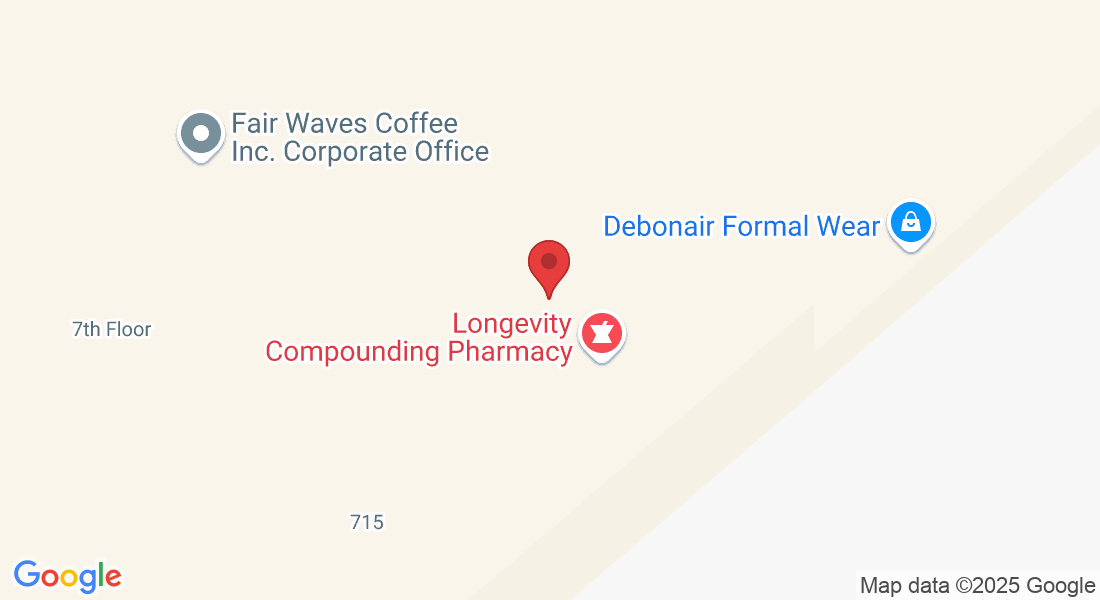

Address : 208-713 Columbia St, New Westminster, BC, V3M1B2

Email: [email protected]

Phone: 1-778-222-2558

Operating Hours:

Mon – Sat 9:00am - 8:00pm

Sunday – CLOSED

Our Office

Address : 208 – 713 Columbia St. New Westminster BC V3M1B2

Email: [email protected]

Phone : 1-778-222-2558